Navigating the Post-Halving Crypto Market: Insights and Expectations May 2024

Bitcoin

Halving

Crypto

Written by

Dreko

Published on

May 09, 2024

In the last macro crypto market summary we focused on the Bitcoin pre-halving environment and what to expect post halving based on historical performance. In this summary, we will focus on the ETF behavior and how it has impacted the price of Bitcoin, and where we are at in the Bitcoin current bull market cycle.

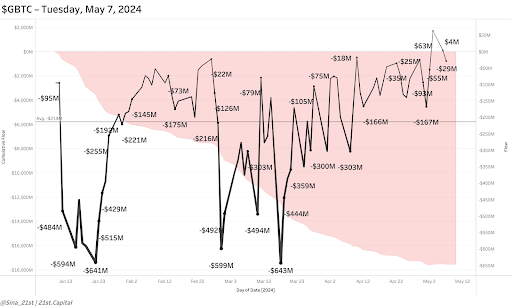

As of Tuesday, May 7th, 2024 Crypto asset manager Grayscale Bitcoin Trust (GBTC) has greatly reduced its Bitcoin (BTC) outflow since January 11th when the Bitcoin ETFs went live. Since then, GBTC holders have been selling their holdings because they were able to purchase BTC at up to a 40% discount leading up to the ETF launch, and the high fees associated with the GBTC ETF holding. In other words, early investors are taking profits. This outflow of funds has had an impact on the price of BTC due to the large amount of selling pressure.

In the graph below, you can see the outflow (selling pressure) that GBTC has been creating is starting to trend down, and has had two notable net inflow days of $63 million and $4 million in May. The average selling of BTC through GBTC has been approximately $214 million per day for the last 79 days (net average). The total net outflow of BTC has been a staggering $17.4 billion worth of BTC sold on the market since January 11th, 2024. If this trend continues, we could see some upside in BTC in the near future with less daily sell pressure, and a potential future where we see GBTC contribute as a purchaser of BTC.

The price of BTC has survived this sell pressure thanks to the positive net inflows from the spot Bitcoin ETFs in the US, and other market participants purchasing BTC. The ETFs maintain a positive balance sheet with BlackRock’s iShares Bitcoin Trust attracting the largest overall investment, with net inflows of $15.5 billion.

Other major net inflow contributors include Fidelity Investments’ Fidelity Wise Origin Bitcoin Fund with $8.1 billion, Cathie Wood’s ARK 21Shares Bitcoin ETF with $2.1 billion and the Bitwise Bitcoin ETF Trust with $1.7 billion. The cumulative positive flow of investments into the spot Bitcoin ETF market is nearly $11.8 billion at the time of writing.

So what's next? Well, based on the previous article we are still in the Re-Accumulation phase where Bitcoin ranges sideways more or less for a few weeks, and could last up to 150 days. But, we are starting to see some positive signs from the ETFs and from daily market activity.

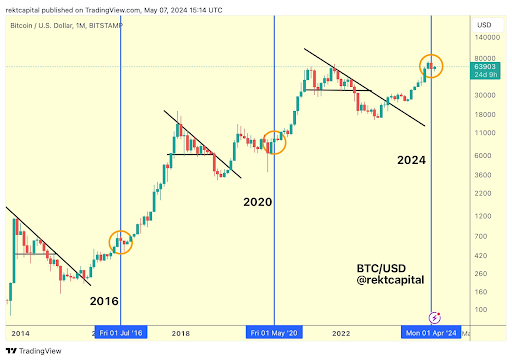

As posted by Rekt Capital, we are past the halfway point of halving volatility as indicated by the orange circles on the chart below. Once we exit this area, historically we have seen the beginning of the next phase of the BTC Bull Market, which would be the Parabolic Uptrend.

Another chart by Rekt Capital shows a comparison of the 2016 bull market and our current price action in 2024. You can see that the price behavior is very similar to the 2016 halving, where we saw an incredible increase in value of approximately 3000% with a blow off top in 2018. We should obviously expect diminished returns, but the historical similarity is there.

In another chart provided by Stockmoney Lizards, we could be witnessing a scenario where Bitcoin re-visits the recent lows set over the past few weeks near $58k-$57K, and then starts to climb its way upward. This potential scenario also falls in line with what rekt Capital is showing in his charts, and could be supercharged by ETF re-interest and more net positive inflows from the ETFs. On the other hand, we could also go back down around $50k where we have historical major support and then reset from there.

Lastly, It is also important to remind people that we are approximately 37% into the bull market. People keep mentioning that they are waiting for the bull market to start. But the bull market started months ago and we are going through phases of this current bull cycle. Be sure not to sit on your hands for too long, or get shaken out by sideways action and misinformation. We could still see some more downside for BTC in the short-term, but the overall trend is still up. The BTC bull market is currently on track and doing fine.

Sources:

https://twitter.com/Sina_21st/status/1788015925607686147

https://twitter.com/rektcapital

https://twitter.com/StockmoneyL